Uranus. Market consensus

Uranus

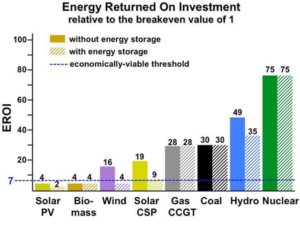

Changing the methods of energy production, which is necessary to reduce CO2 emissions, will require the growth of nuclear generation by 6 times by 2050

- At the beginning of 2022, nuclear energy was included in the list of «green» EU energy sources

- This means that now ESG funds can freely invest money in the promotions of uranium companies

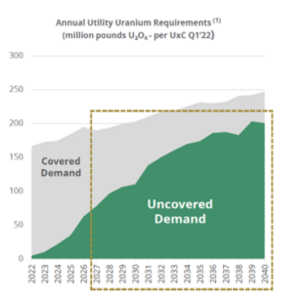

Given the fact that over the past 2 years, the influx of funds on the ESG funds has amounted to $ 1 trillion, and the total capitalization of the two largest Uranus miners-the Canadian Cameco and the Kazakhstani Kazatomprom is only $ 19 billion, the cost of shares can grow very significantly

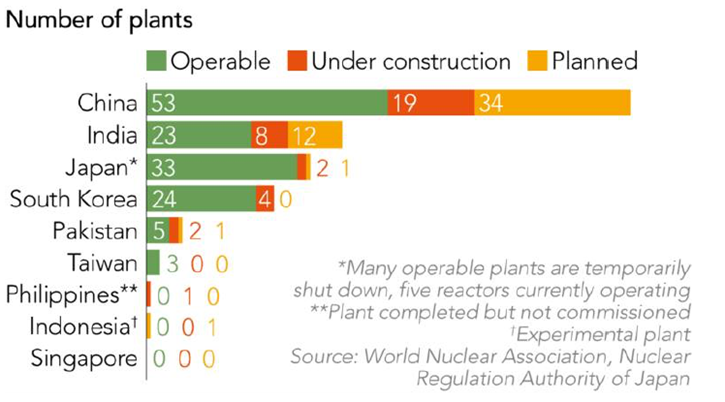

An important driver of an increase in uranium consumption is Asian countries that are in dire need of additional energy:

- China occupies first place in the world in installed nuclear power — in the country there are 53 existing reactors, another 19 are under construction, and 34 are planned

Even Japan for the first time after the disaster on Fukushima seriously thought about increasing the share of nuclear energy in the energy balance, and a survey conducted by Nikkei showed that 53% of respondents spoke out for restarting nuclear power plants, while the government expects that atomic energy will provide about 22% of energy in the country by 2030

In the United States, the Biden administration launches a program worth $ 6 billion to save nuclear power plants, which are facing closing due to financial difficulties

Leading investment banks recommend acquiring shares of the Canadian Cameco (CCJ) — one of the world’s largest Uranus miners

In February of this year, the company said that it would again launch the prey at the MacArthur River field, the extraction on which will amount to 15 million pounds of uranium annually since 2024

- This will allow the company to increase its share in the world production of Uranus

- In 2022, Cameco expects mining at 18.5 million pounds

- The main part of the company’s revenue falls on North and Latin America (50%), the share of Asia is 28% and Europe — 24%

- According to analysts, Cameco growth potential is from 32% to 52% (at the current price of $ 24.8)